Private banks and wealth managers are faced with a new clientele: the Millennials. Self-made men or heirs, these wealthy people, aged between 25 and 40, do not have the same expectations as previous generations. Not meeting these expectations is a major risk of being cornered. What are the solutions to attract and retain Generation Y? In order to implement the appropriate responses, the most important thing is to recognize the generational renewal and to understand their requirements.

Large fortunes: generational renewal

Born between 1980 and 2000, Millennials are the majority in the workforce. This generation Y will reach its demographic peak in 2025 on a global scale. Projections estimate that their combined annual income will reach $8300 billion in the United States alone.

In addition to the dominant influence they will have on consumption and investment, Millennials will also inherit the wealth of their baby boomer parents. Based on data collected by the U.S. Bureau of Statistics and Pew Research, Bank of America Merrill Lynch estimated this legacy as early as 2015 at $40 trillion in wealth. By 2025, nearly three-quarters of the assets will be held by Generation Y.

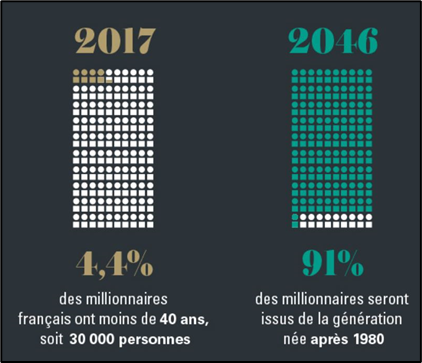

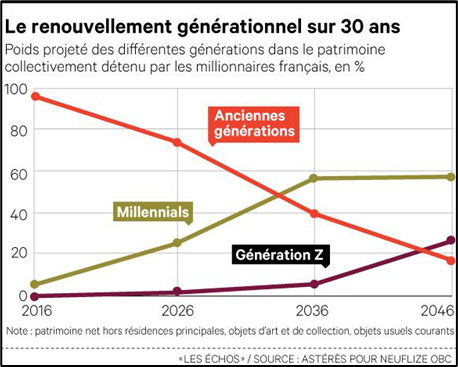

In France, the 30,000 millionaires under the age of 40 gathered a wealth of 40 billion euros[1] in 2017. Between 2026 and 2036, almost all new millionaires will be born after 1980, creating 90% of the wealth during the decade. By 2046, they will represent 91% of millionaires (4% in 2017) and capture 82% of total wealth.

Illustrations taken from the study by Neuflize OBC and Asterès

Not offering young millionaires the right products, services and tools is a strategic mistake, especially since this generation is not a loyal customer. A Pwc study shows that half of them are ready to change their bank advisor.

“The inheritors of wealth over the next five to 10 years will note necessarily choose to keep their parent’s financial advisors. In fact, a recent PwC survey showed asset attrition rates of more than 50 percent in intergenerational tranfers of wealth. This means that companies must design an onboarding strategy for generation X and millennials soon, given that by 2020 they will control more than half of all investable assets, or about USS30 trillion.”

Extract from the Pwc study A revolution both quiet and loud

This rate of departure in case of dissatisfaction climbs to 75% in a Deloitte study[2] :

« This is specifically alarming as 75% of Millennials – a specifically tech-savvy and growing client segment – would switch their private bank if they found a better alternative »

Deloitte Study – Innovation in Private Banking & Wealth Management

While some are even thinking of bypassing private banks to manage their assets, the risk of being left out of the running would be too great. It’s impossible to miss the ambitions and problems of Millennials… as long as you know them well.

What is the investment profile of Millennials?

These 25-40 year olds have shaped themselves in the digital age. The digitalization of the pathways is not a problem if the user experience is there. Fintechs have understood this and are deploying their chatbots to exchange and their robo-advisors to guide them in their investment strategy.

Financial technology start-ups are expanding their time slots, because the demand for flexibility also applies to being reachable. It doesn’t matter if it’s 11 p.m. or Sunday, managing your money must be possible at any time. In addition, the multiple information channels and resources available have increased their financial literacy.

But that doesn’t mean they don’t want human advice – quite the opposite. At the end of the day, private bankers and wealth managers are challenged. They must be able to meet the quality of response expected by this generation.

New themes are emerging. The sharing economy, the climate emergency, and inequalities are their compasses. While yield remains a cardinal point, asset allocation also depends on the values promoted by companies. Hence the rise of green finance products and sustainable investments based on extra-financial criteria (ESG, for Environmental, Social and Governance).

“To attract and retain this new generation of investors, advisors must offer Impact Investing strategies in the social, sustainable development and clean energy fields.

Cabinet CB Insights[3]

Giving meaning to one’s investment sounds like a leitmotif. Millennials are thus exploiting private equity and real estate investments, rather than the stock market. They prefer liquid products to be able to withdraw in case of a storm. However, the wealthiest are not shy about hunting in uncharted territory. A recent CNBC survey[4] indicates that 47% of Millennials with at least $1 million in assets had more than 25% of their portfolio invested in cryptoassets.

Transparency, phygital, engagement: the expectations of the digital native generation[5]

| Top 10 investment expectations of Millennials |

| To be an active player in the management of their assets. |

| To have access to quality advice. |

| Understand the strategy in place in a transparent manner. |

| To keep a certain autonomy to carry out ordinary operations. |

| Use digital channels. |

| Have a responsive contact person “who looks like them”. |

| Exploit innovative solutions (services, products, tools). |

| Align their investments with their values |

| Measure the effects of their investments with clear and educational reporting. |

| Aim for efficient and sustainable financial investments. |

Challenges for private banking: business transformation and platformization

With the upcoming transfer of wealth, private bankers have a key role to play in preparing the succession. They must capitalize on the trust they have built up with the parents of millionaire Millennials in order to become indispensable in the transfer of wealth.

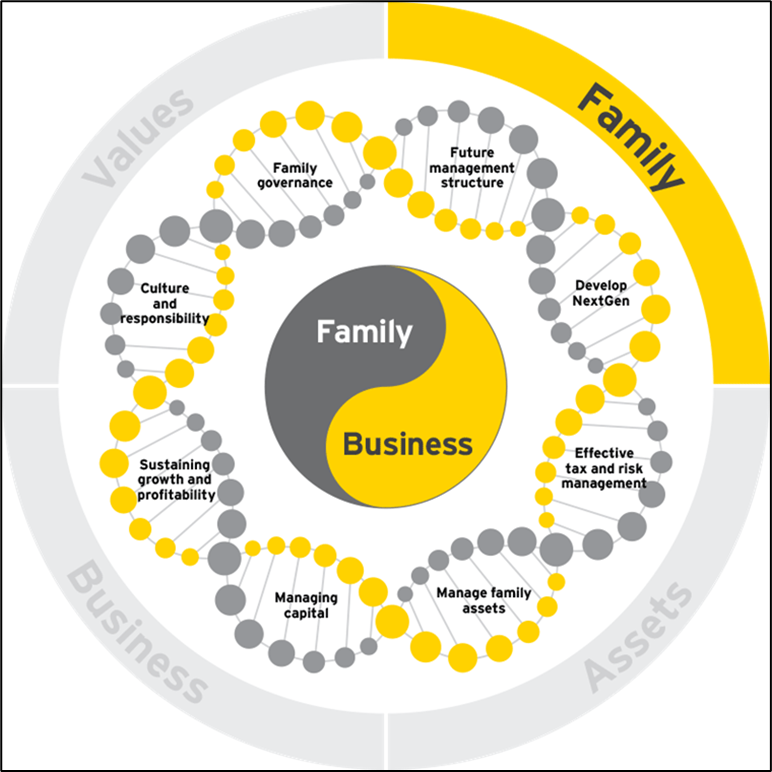

But taking into account the profile of generation Y implies changes in the profession of wealth advisor. Several players are anticipating this movement by inviting banks to become true family businesses. Credit, real estate, private equity: advisors are being trained to manage both assets and liabilities over time.

The 360° positioning of the activities of a family business[6]

The sector is experiencing a diversification of professions caused by the digital transformation. The constant hiring of IT profiles is changing the balance and focus of the teams. But the objective remains the same: to deliver high value-added advice and a unique and personalized customer experience. And if the promise is not kept, Millennials will have fewer qualms about going to the competition or even managing their diversified investments directly themselves.

The exploitation of data collected throughout the customer journey should encourage the implementation of measures to retain them and build loyalty. In this respect, digitalization and process automation are competitive advantages. Not only do these measures contribute to improving the user experience demanded by Millennials, but they also meet the challenges of cost optimization.

This picture explains the growing attraction of Wealthtech for tools that guarantee more speed, efficiency, security and transparency in pricing and services available. The Hokus Platform supports asset managers in streamlining their workflows. The objective is to reduce by 90% the processing time of a life insurance contract. A benefit in onboarding, both for the professional and for the client.

We would be delighted to explain in detail the many advantages of our solution.

[1] https://asteres.fr/site/wp-content/uploads/2019/08/Aster%C3%A8s-Etude-nouveaux-entrepreneurs-VWebsite-Revu-CAS.pdf « Les millionnaires millennials. Comment les nouveaux entrepreneurs réinvestissent-ils leur patrimoine ? »

[2] https://www2.deloitte.com/content/dam/Deloitte/ch/Documents/financial-services/ch-fs-en-innovation-in-private-banking-and-wealth-management.pdf

[3] https://www.cbinsights.com/research/impact-investing-millennials-fintech/

[4] https://news.chastin.com/selon-une-enquete-de-cnbc-les-jeunes-milliardaires-detiennent-une-grande-partie-en-crypto-monnaies/

[5] http://www.eclaireursdelacom.fr/authenticite-transparence-les-attentes-des-millenials-vis-a-vis-des-marques/